Why Best Capital Options?

Empowering Financial Success, Together.

Welcome to Best Capital Options, the premier capital solutions provider for businesses looking to grow and succeed. Our team of experienced financial experts understands the challenges facing entrepreneurs and business owners today, and we’re here to help you overcome them.

Founded in 2023, Best Capital Options has launched as a trusted partner to businesses across a range of industries, providing customized lending solutions that are tailored to your specific needs. We know that every business is unique, which is why we take the time to understand your goals, your financial situation, and your vision for the future.

The timeline of business.

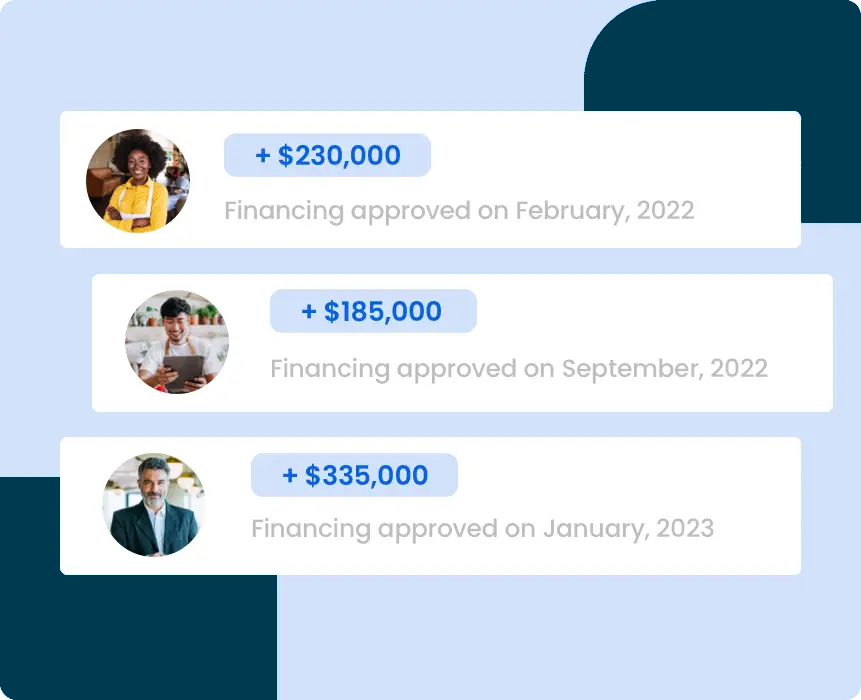

Welcome to Best Capital Options, your trusted partner for small business lending. We understand that securing financing can be a challenge, which is why we’re dedicated to providing our clients with the best terms and rates in the market.

Our team of financial experts will work with you to tailor a financing solution that meets your specific needs and goals, whether you’re looking to expand your business, purchase new equipment, or cover unexpected expenses. With loan amounts ranging from $10,000 to $10,000,000, we’re committed to helping small businesses succeed.

At Best Capital Options, we believe in building lasting relationships with our clients based on trust, transparency, and exceptional service. Contact us today to see how we can help you take your business to the next level.

Flexible financing solutions and world-class service, we are dedicated to providing

outstanding customer service and creating success for our customers.

Constructing a viable and expandable scheme of financing that allows small companies to succeed.

Ensuring our clients have all the details concerning our products to enable them to make knowledgeable choices.

Making sure that all elements of the CapitalGurus experience surpass the highest quality standards.

We believe in acting as a reliable partner and showing respect to our customers in all interactions,

Ensuring the privacy and protection of our customers’ data and revealing how borrower data is used.

Attracting and retaining the top personnel in the industry by creating incredible incentives and environmnent.

Long term, low interest loans for the purchase of fixed assets such as real estate, equipment or machinery

Long term loans which are paid back with regular payments over time, including interest

Loans or leases specifically for the purchase of business equipment or car loans

Loans or leases specifically for the purchase of business equipment or car loans

Small loans which usually must be repaid in two years or less

Invoice financing allows you to access quick cash against current unpaid invoices

Technically not a loan, and payments are a percentage of each sale

A loan secured by commercial real estate to purchase, refinance, renovate, or for